With rental property management in Auckland (even if it’s only casual letting service) it is important to monitor economic information being published from credible sources so that we can make predictions, keeping both our Landlords and tenants informed of pending changes to market rent rates.

Rental property management service involves keeping the property at market rent rates (above market rent leaves you liable at law, and under effects your investment returns). It is important to keep the tenants informed that rent is reviewed every 180 days, and the likely impact on the cost for them, this helps to reduce frustrations, and rent arrears.

We have reviewed the recent ANZ property focus for insights to use for your property management service, or property investment considerations, weather you’re on the hibiscus coast, north shore or Auckland, it’s important your property manager is up to speed on the NZ economic indicators.

So here’s a summary of what I found relevant to rental property management, rental property investment, and what it could mean for you:

Net Permanent Long Term migration is the highest it has been in over a decade, (historically where migration increases hose pricing follows shortly after, and we can expect similar results for rental pricing).

Housing supply is still lagging behind demand (which increases demand, a direct relation to what we can expect to happen to rental pricing, although this has historically created a knee jerk reaction in tenants where families move in together, and more people crowd into rentals to keep their costs down). What’s important here is to specify number of tenants permitted in your rental in accordance with your desire or maximising by what’s legally permissible to increase short term gains.

When conducting your regular property inspections (which should be undertaken in accordance with your insurance at the VERY LEAST!) ensure you are looking for tell-tale signs of more residents than signed on your agreement, this goes again for your monthly drive-bys and looking at how many cars are on the property.

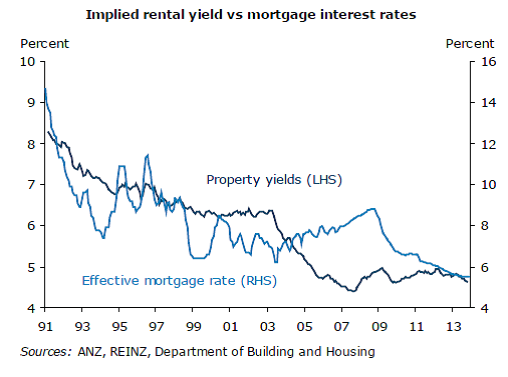

ANZ states rental Yields are lagging compared to historical figures but also comment that they are moving in tandem with mortgage rates, so therefore if the OCR is hiked next year there is likely to be follow through to market rent.

ANZ sound like they believe that our current annual rental increases will heat up, on the back of OCR expectations. As the graph below

(source: ANZ Economics) rental yields follow mortgage rates but due to rental review laws rental yields don’t fluctuate as fast

mortgage rates (since the OCR is reviewed quarterly, and Rents every 180 days Max).

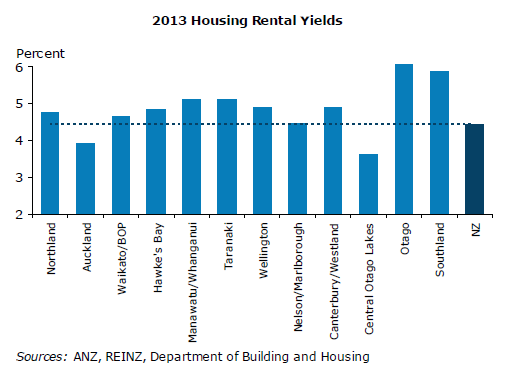

For our country-wide investors you may find the Graph below interesting when considering your next purchase (bearing in mind that Yields are

related to risk):

As usual, for those of you considering development of the coming years, the Christchurch rebuild and Auckland housing demand are set to

clash of labour and material demand, which will flow through to construction cost inflation.

For those who can afford to develop and have the potential now is a good time to do your feasibility studies and get in before the rush, all

the trusted builders I have spoken to recently are currently in high demand.

Expectations of Mortgage rate increases could pose this to be a good time to consult your broker about your borrowing strategy for early next year.

I found this ANZ Property Focus economic report to be highly informative, the writing in this article is a summary of the points that the author found interesting, it is not a basis for investment advice, but a personal interest piece to encourage thought and highlight the availability of great resources available from sources such as those published by ANZ Economists.

Whether you are considering property management, property investment or any other professional service it is always advisable to engage the services of a company that demonstrates integrity, and is focused on your needs.

Your thoughts, comments and opinions are always welcome: sam.coutts@mylandlord.co.nz

Read the full report here: ANZ Property Focus November 2013